“Sometimes carrying on, just carrying on, is a superhuman achievement.” -Albert Camus. That’s exactly what the Bangladesh leather industry did during the COVID-19 pandemic. It carried on, despite cancellations of millions of dollars worth of orders of raw materials and goods. Thousands of redundancies and a decline of confidence in the economy of the nation. The story of the Bangladesh leather industry during the outbreak of the deadly coronavirus is fraught with despair and challenges. But most of all, it is a remarkable story of hope. And hope is what we very desperately need in these particularly trying times.

The Backdrop of Bangladesh’s Leather Industry:

Leather is the second largest earner of foreign currency in Bangladesh after RMG, with competitive advantages listed below:

- available hides are fine in grain pattern and uniform in fibre structure,

- highly-competitive labour costs,

- a steady (and annually increasing) supply of cattle skin each Eid-ul-Adha.

Therefore, it has been identified by the Bangladesh Government as a thrust sector for export. In fact, leather and footwear combinedly account for 3.3% of the country’s overall export basket. With 220 tanneries, 2,500 manufacturing units and 90 larger firms currently operating in the country.

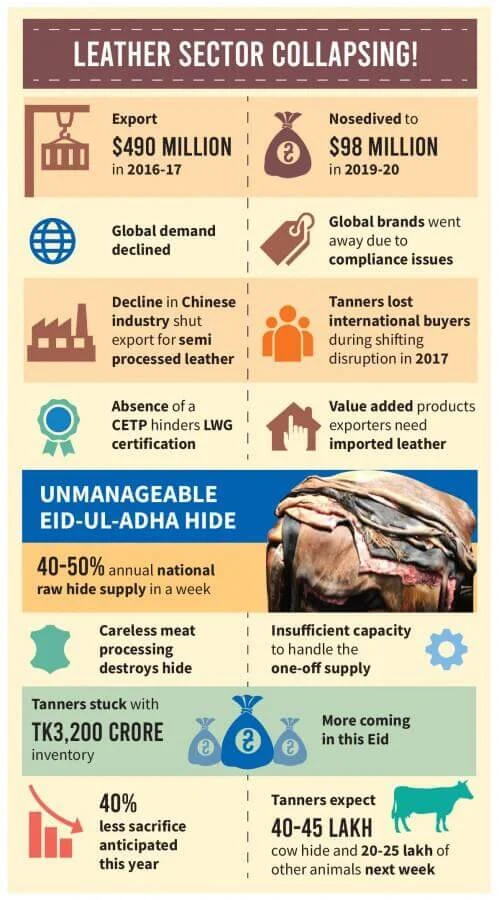

However, despite the fair price set by the government for hides of slaughtered bovines during Eid-ul-Adha, the year 2019 was not favourable for the leather industry due to the reasons outlined below:

- Price shock caused by a decline in global demand,

- Delay in the construction of an industrial park for tanneries in Savar,

- Slow relocation of tanneries from Hazaribagh to the Savar Leather Industrial Park,

- Lack of a functional central effluent treatment plant (CETP),

- The resulting delay in achieving Leather Working Group (LWG) certification,

- Insufficient financing available to tannery owners.

All of these resulted to a waste of close to 100,000 pieces of rawhides that year. See the infographic for visual reference.

While problems were starting to brew inside the country, the export arena showed up with a different set of challenges. Out of Bangladesh’s total production, only 30 per cent of the finished leather is consumed locally. The remaining 70 per cent is exported, mostly to China, that imports nearly 50% of Bangladesh’s crust leather!

At the same time, Bangladesh imports much of the raw materials and accessories required for the leather industry from China. So, inevitably, China has its own leather-processing industry competing with us.

Another key player present in the South Asian leather scene is Vietnam. Syed Nasim Manzur, head of Apex Group, remarked about the Vietnamese competition,

“Despite having raw materials for leather products, we were unable to make the expected progress. However, despite the lack of raw materials, exports in this sector in Vietnam have gone a long way.”

So, Bangladesh’s leather sector was failing to make it big internationally even with an abundance of rawhide and a skilled workforce. It is with these menacing omens that the latest threat to Bangladesh’s leather sector arrived, in the form of COVID-19.

Effect of COVID-19 on the Bangladesh Leather Industry (Raw materials for leather goods)

In an instant, all factory activities within China came to a grinding halt. As a result, Bangladesh’s leather goods and footwear exporters became crippled early in January. Since the necessary raw materials for hide processing couldn’t be imported from China. F.M. Rafiqul Islam, Technical Director of the Dhaka Hides, feared that each large tannery may face stockpiles worth Tk.10 crore to Tk.12 crore with the extension of China’s lockdown. By March, the sector had counted losses of nearly Tk.450 crore. According to Shaheen Ahmed, Chairman of the Bangladesh Tanners Association (BTA). (Source: Dhaka Tribune)

In fact, with the outbreak of COVID-19, no one could foresee the extent of the damage that was to happen. Especially to industries that are not deemed “necessities”, like airlines, tourism and hospitality. So, while online businesses boomed at unprecedented rates. Large aviation groups like Thai Airways, Virgin Atlantic and Alitalia neared bankruptcy. Tourist destinations across the world came to a standstill. Crippled by tremendous losses of life.

Like most such industries, Bangladesh’s leather industry appeared to be in the same trajectory too. With the closure of factories due to lockdown. Exporters of leather goods and crust leather, faced cancellations amounting to around $253 million! The sector people were further unable to cash in on the local market of about Tk.1,000 crore during the Eid-ul-Fitr. Due to a lack of raw materials for leather goods.

Overall, leather, leather products and footwear exports registered an export earning of US $798 million FY’20. This was a reduction of 21 per cent from $1.019 billion in the corresponding period of 2019. This data collected by the Export Promotion Bureau (EPB) is also presented graphically below:

Consumption Patterns During COVID-19

As the outbreak triggered the first few weeks of lockdown, like the business people, the consumers had no clue what to expect. Indeed, to the many who hadn’t encountered the virus first-hand, it appeared like a holiday. But there was one difference – it was a “stay-cation”. You couldn’t really go crazy shopping, with the closure of virtually all stores and outlets. So, naturally, both the luxury and the fast fashion industries were forced to face losses and cutbacks in the first months of the pandemic. At the same time, one of the most anticipated deals between big-time luxury labels Moët Hennessy Louis Vuitton SE (better known as LVMH) and Tiffany\’s fell apart. Fortunately, the acquisition was recently completed on January 7th, 2021.

As soon as lockdowns were eased, shoppers in France began to queue for their dose of “retail therapy”. Crowds gathered at both designer labels like Chanel and contemporary outlets like Zara, H&M and BHV. There was also a large shift of most luxury brands selling their expensive wares over websites or “e-tailers”. The online showcasing of the Paris, Milan and Shanghai Fashion Weeks has further sated consumers from their own homes!

In fact, one of the biggest phenomena during the pandemic was “shoptimism”. It\’s a term coined by the former Land’s End creative director and Esquire Magazine editor Lee Eisenberg. Denoting the consumer’s purchase of “feel-good pieces” during troubling times. This is backed by science too. In the early months of the pandemic, Amperity, a consumer data analytics firm tracked consumer spending by category. It recorded huge plunges in spending in the first week of April on “home, jewellery, and leisure” and “fashion and apparel”. The following week though, spending in both those categories experienced a notable uptick. In the U.S., marketing firm Qubit reported a 2% rise in luxury spending in late March even as fast-fashion sales plunged 40%. (Source: Medium)

Furthermore, luxury brands are particularly reliant on Chinese consumers. They have not only driven 70% of their global growth since 2012 but have been the most affected by the COVID-19 outbreak thus far. As the two-month lockdown in China began to lift in mid-April, expenditures on “some of the biggest high-end brands” surged. The Wall Street Journal reported, citing a spike in luxury brand LVMH sales at its newly reopened boutiques, among other examples. In a similar fashion, on the first day of its reopening a single Hermès store (the house behind the fabled Birkin bag) in China clocked in $2.7 million in sales! According to Bain & Co., the share of Chinese consumers’ high-end purchases made in mainland China more than doubled from 32% in 2019 to over 70% in 2020. (Source: The Hindustan Times)

But that’s not to say that the fashion business is alive and well. “The industry could lose €30-40 (£26.34-35.12) billion in sales this year as the sector’s value drops to €309 (£271.30) billion…, a five-year low,” the Business of Fashion has predicted.

So, What is the Good News for the Bangladesh Leather (Raw Materials) Industry?

While consumer spending seemingly went haywire, the bleakness in Bangladesh began to lift. As factories started to reopen in May. This resulted in a spike in exports in June 2020. It is also during this period that the patterns began to emerge. During the July-September period of the fiscal year of 2020-2021, leather shipments again declined by 22.45% year-on-year. And that of leather goods fell by 4.15% to $605.67 million. But leather footwear exports increased by 0.20 per cent to $377.34 million. The global footwear market is expected to reach $320 billion by 2021. The domestic market size of footwear is also around Tk.17,000 crore, demanding 200 to 250 million pairs a year. So, this growth, especially in the stagnating period of the pandemic, is highly positive.

At the same time, the Business Confidence Index (BCI) of the South Asian Network on Economic Modeling (SANEM) went up to 55.24% in October-December from 51.06% in the previous quarter. Firms already hopeful about the first quarter of 2021 as the BCI is expected to rise to 57.90 per cent. (Source: The Daily Star)

Not only that, Salman F. Rahman has suggested a quick partnership with Vietnam to advance the leather sector. He is the Private Sector Industry and Investment Adviser to Bangladesh’s Prime Minister Sheikh Hasina. And also co-founder and vice-chairman of the Beximco group. He justified this with his saying, “this is because even though Vietnam has progressed in the leather industry, it does not have raw materials.”

The President of the Leathergoods and Footwear Manufacturers & Exporters Association of Bangladesh (LFMEAB), Md. Saiful Islam, is more hopeful about the US investigation into Vietnam’s currency devaluation, thus giving Bangladesh an opportunity to regain a competitive edge over Vietnam. At a recent virtual event, Mr Saiful Islam, along with several exporters, said, “businesses from Vietnam, Japan and Taiwan are keen to invest in Bangladesh. Thus take its trade benefits on exports. And the benefit of low production costs and cheap source of raw materials & workforce.”

Another significant development amongst the leather-producing nations of the world is China. It has started to lose its European market share in leather and leather products due to increasing wages and rising domestic demand. Michael Scherpe, president of Messe Frankfurt France (world\’s largest trade fair organizer), told reporters in Dhaka recently. He said, “Raw materials are a promising category and there is a lot to do in Europe”. Asia is exporting only 3% of the raw materials needed by Europe. But few European countries together account for 33 per cent. (Source: The Fashion Network).

Both China and Vietnam are embroiled in domestic and legal issues. So, Bangladesh is now open to more opportunities than ever. Thanks to the changes in consumer behaviours that are clearly indicative of a luxury-craving market in the post-pandemic era.

Hope in Darkness!

“If the approximately 165 footwear and leather factories currently operating in Bangladesh were compliant and used modern technology, they could fetch over $5 billion in export receipts!” Both Saiful Islam and the nation’s Commerce Secretary Md Zafar Uddin are hopeful. (Source: The Business Standard) In the given situation, it is crucial to restore buyers’ confidence through ensuring compliance and certification from the Leather Working Group (LGW). The LGW audit resumed last year. Hopefully, they can cover 7400 tanneries with 11 auditors deployed for inspection.

Another big advantage that the leather manufacturers in Bangladesh can and should consider is providing exclusively-catered, bespoke online experiences. These should be customer-friendly websites, especially on mobile devices. They must recognise the difference between a brand new customer with a returning customer. Though “shoptimism” is a buzzword now, with the transition to shopping online, consumers are now demonstrating an affinity towards pre-research. Plus with 73% of online sales set to be conducted via mobile by the end of 2021. Thinking about designing a seamless mobile experience for users is key.

Premier luxury houses have already jumped onto this trend. Snapchat has launched a try-on ‘Lens with Guccil’, allowing its young “shoptimistic” audience to try on Gucci sneakers in augmented reality. (Source: Smart Company).

One more recommendation instrumental for Bangladeshi Leather manufacturers to adopt is to properly position their own leather goods. As per Bangladesh’s industry insiders, leather goods are considered to be semi-luxury products. Customers are not interested to buy during times of crisis. But by analysing consumer behaviours, we have witnessed that the most “shoptimistic” of them, mostly millennials and Gen Z-ers, actively seek either the low-value, feel-good products. Particularly those with price points under $100. Or, as in the Chinese market, high-value luxury labels. So, in this scenario, trying to remain a purveyor of semi-luxury isn’t the best of both worlds as we’d ideally think. rather it’s a model trying to serve a non-existent customer base. Our leather manufacturers need to be certified, equipped and optimally utilized to provide the premium quality of leatherware. Ready to craft for this well-informed and aware consumer base of the post-COVID world.

The pandemic appeared as an unexpected period of economic downfall. Countless lives and way of life are in jeopardy. Regarding the situation, Elle Magazine UK has stated that the fashion industry is both a “creative mecca and one of the world’s most significant fiscal heavyweights”. And its deterioration would see a serious impact on the global economy. Not to mention the lost jobs or unemployment status of millions of artists, designers, seamstresses and more. Yet, things are healing or people are getting used to the new norm.

The leather industry of Bangladesh got off to an unfavourable start during the pandemic. Like all other industries, it faced challenges that seemed impossible to overcome. However, through this difficult time, the industry has not only survived but also emerged with more opportunities than before. We have learned lessons that has the potential to lead to tremendous growth. This is a test of resilience. Not only of individual industries but of the economy as a whole. The very fact that our leather sector has “<em>carried on</em>”, to borrow Albert Camus’ wise words, makes it immensely hopeful that we’re on the verge of achieving great things.